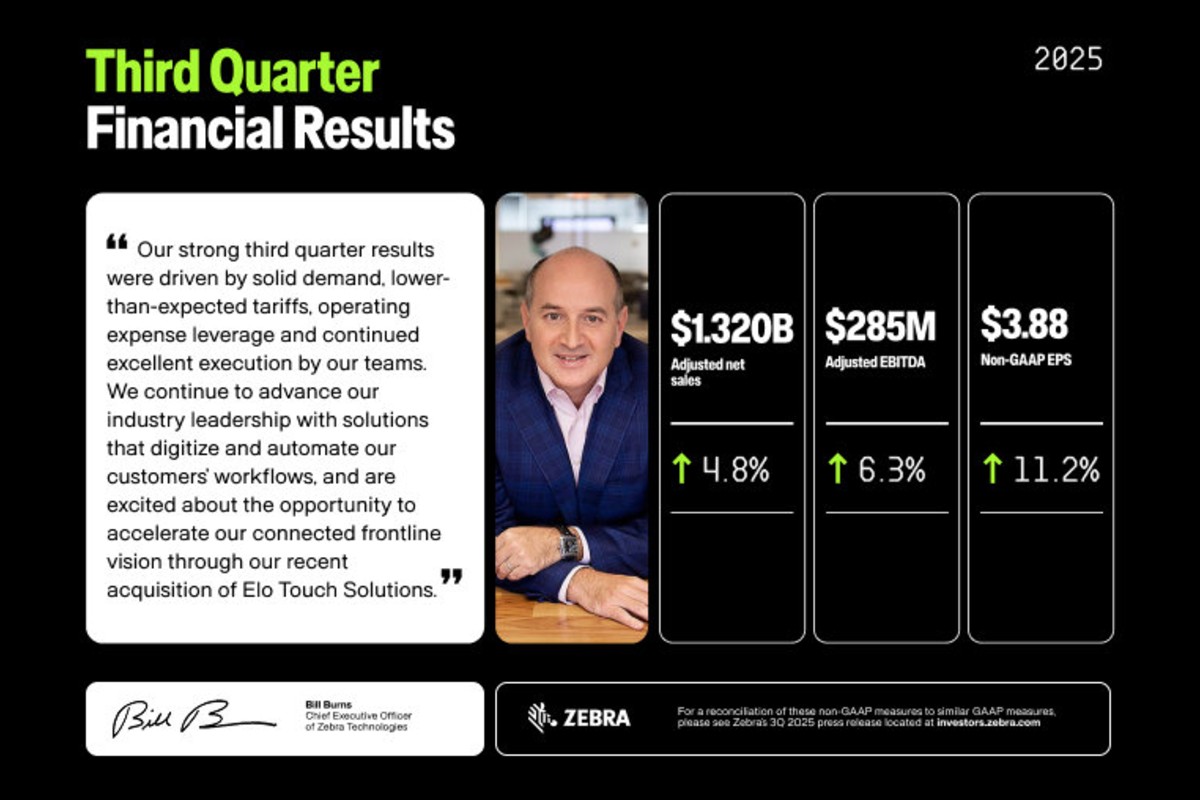

Zebra Technologies announced third-quarter 2025 revenue of $1.32 billion, a 5.2% year-over-year increase. Net income stood at $101 million, or $1.97 per diluted share, while non-GAAP diluted EPS rose to $3.88. Adjusted EBITDA grew to $285 million, supported by steady demand, lower tariffs and controlled operating expenses.

The Enterprise Visibility & Mobility (EVM) segment recorded sales of $865 million, up 2% from last year, while the Asset Intelligence & Tracking (AIT) segment rose 10.6% to $455 million. Gross margin was slightly lower at 48%, mainly due to U.S. import tariffs. The company repurchased $284 million in shares year-to-date and plans to buy back an additional $500 million by Q3 2026.

Zebra closed the quarter with $1.05 billion in cash and $2.18 billion in total debt. Free cash flow for the first nine months reached $504 million. Looking ahead, Zebra expects Q4 revenue growth of 8-11% and non-GAAP EPS between $4.20 and $4.40. The company aims to maintain strong cash flow while integrating its Elo Touch Solutions acquisition and reorganizing into new operating segments in Q4 2025.

To read the full report click – https://www.zebra.com/content/dam/zebra_dam/global/zcom-web-production/web-production-photography/press-releases/q3-2025-earnings-press-release.pdf

Leave a comment